lechsstavv.ru

Tools

How Do U Get A Vpn

Go onto a VPN provider's website. Choose your plan. Enter in your name and payment information to purchase. How do I get a VPN for free? To get a. Windows users can connect to a VPN through the "Network & internet" section of their PC's Settings, or via the official app from a VPN provider. · On macOS. To get started, you'll need a VPN client, a VPN server, and a VPN router. The downloadable client connects you to servers around the world. Create a Google Cloud account. You can use your existing Gmail account to log in or create a new one. Either way, you'll get free credits if you're a. And in some rare cases if two clients used the source source port, the VPN might have to change the source port too and not just the IP address. Some popular VPN providers include NordVPN, ExpressVPN, CyberGhost, and Surfshark. 2> Sign Up: Once you've chosen a VPN provider, visit their website and sign. Open your device's Settings app. · Tap Network & internet And then VPN. If you can't find it, search for "VPN." If you still can't find it, get help from your. VPN apps tailored for smartphones and tablets make it easy for you to use the service for a secure connection wherever you get online. For an iPhone or iPad. Actually setting up a VPN is very simple. You could set up a VPN on your home router most likely. I'd suggest spinning up an OpenVPN server for. Go onto a VPN provider's website. Choose your plan. Enter in your name and payment information to purchase. How do I get a VPN for free? To get a. Windows users can connect to a VPN through the "Network & internet" section of their PC's Settings, or via the official app from a VPN provider. · On macOS. To get started, you'll need a VPN client, a VPN server, and a VPN router. The downloadable client connects you to servers around the world. Create a Google Cloud account. You can use your existing Gmail account to log in or create a new one. Either way, you'll get free credits if you're a. And in some rare cases if two clients used the source source port, the VPN might have to change the source port too and not just the IP address. Some popular VPN providers include NordVPN, ExpressVPN, CyberGhost, and Surfshark. 2> Sign Up: Once you've chosen a VPN provider, visit their website and sign. Open your device's Settings app. · Tap Network & internet And then VPN. If you can't find it, search for "VPN." If you still can't find it, get help from your. VPN apps tailored for smartphones and tablets make it easy for you to use the service for a secure connection wherever you get online. For an iPhone or iPad. Actually setting up a VPN is very simple. You could set up a VPN on your home router most likely. I'd suggest spinning up an OpenVPN server for.

Click the Windows Start button and select the Settings cog. · Under Windows Settings, select Network & Internet. · Select VPN from the left menu, then at the. When you switch on a VPN, it creates an encrypted connection (sometimes called a "tunnel") between your device and a remote server operated by the VPN service. VPN software on your computer establishes a secure point-to-point tunnel through the Internet with your office to access files remotely. In order to have a. And in some rare cases if two clients used the source source port, the VPN might have to change the source port too and not just the IP address. Visit their websites, sign up for a free account, and download their VPN software or app. These services often have user-friendly interfaces and. A VPN can extend access to a private network (one that disallows or restricts public access to some of its resources) to users who do not have direct access to. This makes it difficult for uninvited third parties to access your secure connection. The history of VPNs. Since humans have been using the internet, there has. VPN apps tailored for smartphones and tablets make it easy for you to use the service for a secure connection wherever you get online. For an iPhone or iPad. Create a VPN profile · Select Start > Settings > Network & internet > VPN > Add VPN. · Under Add a VPN connection, do the following: For VPN provider, choose. Getting a VPN · If you're using a PC, double-click the file you download from the website (usually ends lechsstavv.ru), and then follow the on-screen instructions to. You can either access the VPN via your VPN provider's app or by entering their VPN settings directly onto your device. Newer devices have an option in the. A VPN, which stands for virtual private network, establishes a digital connection between your computer and a remote server owned by a VPN provider. How to Set Up a VPN · Step 1: Choose Your VPN Service · Step 2: Download and Install the VPN Application · Step 3: Configure Your VPN Settings · Step 4: Connect to. How to install a VPN on most Smart TVs · Sign up for a suitable VPN. · Search for your VPN in the Google Play Store. · Log in and connect to a server in the. How to setup a VPN on a router · Open System Preferences from the Apple menu; · Then, click on Network; · Here, select Wi-Fi -> Advanced -> TCP/IP; · You will find. How to Set Up a VPN · Step 1: Choose Your VPN Service · Step 2: Download and Install the VPN Application · Step 3: Configure Your VPN Settings · Step 4: Connect to. The best way to get a VPN on your PlayStation is to connect it to a VPN router. And the easiest way to do that is to get an Aircove, the first and only Wi-Fi 6. A VPN is your best option to stay private and secure online. With ExpressVPN, it's as easy as 1‑2‑3! Get ExpressVPN. To get help with the built-in client, see Connect to a virtual private network (VPN) on Android. EMM config. You can configure many VPNs using an EMM console—. Go to the Apple App store on your iPhone and find an app for the VPN provider you've chosen. Tap “Get” and “Install” or double-check to install the app on your.

Can You Send Money From Cash App To Chime Card

Yes, you can transfer money from Cash App to Chime. However, you can't transfer the funds directly since Cash App does not directly work or. When you will open your Cash App account. · You will see an option called Add Bank; click it. · Now choose Chime as a linked bank. · Then open the. Link you're cash app card to your chime then you send the money from cash app and it comes off your chime I do it all the time. Upvote 2. Zelle®: A fast and easy way to send money Whether you're paying the sitter, settling up on a group gift or paying for your part of the pizza, all you need is. All you need is our mobile app. Play Video How to Send Money with Zelle® (Opens Pop-up). Now everyone 13 and up can send money to friends, get a Cash App Card No matter if you swipe your physical Cash Card or tap to pay with Apple Pay. If you are thinking of transferring money from Cash App to Chime, you must link both of your accounts to transfer money. Once the accounts are linked, choose “. Yes, you can send money from Chime to Cash App. Link your Chime account to Cash App and transfer funds easily between the two. Also, you can add your Chime. Once the retailer accepts your cash, the funds will be transferred to your Chime Checking Account. Cash deposit fees may apply if using a retailer other than. Yes, you can transfer money from Cash App to Chime. However, you can't transfer the funds directly since Cash App does not directly work or. When you will open your Cash App account. · You will see an option called Add Bank; click it. · Now choose Chime as a linked bank. · Then open the. Link you're cash app card to your chime then you send the money from cash app and it comes off your chime I do it all the time. Upvote 2. Zelle®: A fast and easy way to send money Whether you're paying the sitter, settling up on a group gift or paying for your part of the pizza, all you need is. All you need is our mobile app. Play Video How to Send Money with Zelle® (Opens Pop-up). Now everyone 13 and up can send money to friends, get a Cash App Card No matter if you swipe your physical Cash Card or tap to pay with Apple Pay. If you are thinking of transferring money from Cash App to Chime, you must link both of your accounts to transfer money. Once the accounts are linked, choose “. Yes, you can send money from Chime to Cash App. Link your Chime account to Cash App and transfer funds easily between the two. Also, you can add your Chime. Once the retailer accepts your cash, the funds will be transferred to your Chime Checking Account. Cash deposit fees may apply if using a retailer other than.

Cash App does not guarantee the availability of Gift Cards for any merchant. There are no fees to send or accept a Gift Card, and once a Recipient accepts a. If you have a Cash App account, you can receive transfers from your Square account into Cash App. This option is available for standard transfers only (not. Are there any fees to use the Instant transfer feature? Instant Transfers sent from a linked debit card to your One Cash account are fee-free. A fee of %. We still do not support online only banks, so while you may be able to link your card, it is expected behavior that the card will continually unlink/unverify as. To fund your Chime account, you can link an external bank account or debit card within the Chime app. This can be done by selecting Move Money. Send money abroad to your loved ones. Fast and secure international money transfers with the Sendwave app. Trusted by one million users around the world. Domestic recipients can cash money orders at either the post office or their bank. Security: You may be able to have money orders replaced if they're lost. A: Yes, you can transfer money from Chime to Cash App without a debit card. The transfer process relies solely on your linked bank account. Sending Money from. If you have a prepaid gift card, then you don't have to stress yourself because you can use PayPal to transfer cash from your card to your Cash app. All you. Step 1: Add your Cash App Card to Google Wallet · Launch Google Wallet · Tap '+ Add to Wallet' · Select 'Payment Card' and then 'New credit or debit card' · Follow. Fortunately, transferring money from your Chime account to Cash App isn't difficult at all! You'll just need to link your Chime debit card or bank account to. You can use Pay Anyone to send money instantly to Chime members and anyone else, but you can also count on Chime to be your one money app for checking, savings. You can transfer money from your Apple Cash card instantly or within 1 to 3 business days. How to transfer money to your bank or eligible debit card. When you. Chime is The Most Loved Banking App®. Get Paid When You Say with MyPay™, overdraft fee-free with SpotMe®, and improve your credit with Credit Builder. Learn how to transfer money to another bank account · Create your profile · Choose where and how much · Enter who will get the money · Pick your payment option. Problem Linking Bank Account · Tap the Money tab on your Cash App home screen · Press Cash Out and choose an amount · Select Standard ( business days) · Type “. Some debit cards don't consistently support the transaction networks we use to send funds instantly, so in these cases we're unable to send the funds. Send money abroad to your loved ones. Fast and secure international money transfers with the Sendwave app. Trusted by one million users around the world. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY. Chime Checking Account and routing numbers. Link your Chime Account to Venmo, Zelle, PayPal, or Square Cash apps using your Chime Checking Account number and.

How To Print Walmart Paystub

How to fill out Walmart paystub information: ; Visit the Walmart employee portal or mobile app. ; Log in using your employee credentials. ; Locate the. Former Walmart employees and alumni can find their information about their k, W2s, paystubs, and COBRA insurance options here. How do I print my pay stubs at one Walmart? Go to the website's homepage, log into your account, click Money, and generate your pay stub. Walmart, in partnership with TALX Corporation, is pleased to announce "The Your PIN# is your current earnings from your most recent paycheck stub. How do I make my account eligible for remote eSign and/or reduced paper printing? We're in your neighborhood & inside your favorite Walmart store. 40+ YEARS. here are the steps: click payroll and select the employees tab. 5 open the pdf and print it. and it' s password protected. or at a computer at home, log into. Go online and log into WalmartOne pay stub portal and click on “Print Termination Paystub”. If you don't have access to WalmartOne, then contact the Payroll. How to Reprint Paychecks and Pay Stubs? · Go to the "Employees" menu and select "Payroll." · Choose the name of the employee you want to reprint the paycheck or. Welcome! The 4-digit PIN you set via phone or the FD Printer allows access to this website. If you do not have a PIN, select Register Now. How to fill out Walmart paystub information: ; Visit the Walmart employee portal or mobile app. ; Log in using your employee credentials. ; Locate the. Former Walmart employees and alumni can find their information about their k, W2s, paystubs, and COBRA insurance options here. How do I print my pay stubs at one Walmart? Go to the website's homepage, log into your account, click Money, and generate your pay stub. Walmart, in partnership with TALX Corporation, is pleased to announce "The Your PIN# is your current earnings from your most recent paycheck stub. How do I make my account eligible for remote eSign and/or reduced paper printing? We're in your neighborhood & inside your favorite Walmart store. 40+ YEARS. here are the steps: click payroll and select the employees tab. 5 open the pdf and print it. and it' s password protected. or at a computer at home, log into. Go online and log into WalmartOne pay stub portal and click on “Print Termination Paystub”. If you don't have access to WalmartOne, then contact the Payroll. How to Reprint Paychecks and Pay Stubs? · Go to the "Employees" menu and select "Payroll." · Choose the name of the employee you want to reprint the paycheck or. Welcome! The 4-digit PIN you set via phone or the FD Printer allows access to this website. If you do not have a PIN, select Register Now.

Walmart Alumni And Former Employee Info: W2 / Paystub / Cobra Insurance Options. Me. Walmart Alumni And Former Employee Info: W2 / Paystub / Cobra Insurance. How do I find the site to print my paystub for my walmart pa Customer. I just need my password *****. img. logo. Software technician: Andy Tech. Thank you. If you have previously logged into the ADP portal to get your paystub or W-2 from your former employer, you can try and access your information. If you are. Exclusive for Walmart Associates: Quick Direct Deposits, Seamless Shopping, Bill Payments, Transfers, and Money Management in the App from Exceed – All. Edit, sign, and share walmart paystub online. No need to install software, just go to DocHub, and sign up instantly and for free. How To Print Page Content · Language Assistance · Job Openings (link is external) DES coordinated with Walmart, Amazon, and Aldi, to enable online Nutrition. OR Go to lechsstavv.ru and click the Log In Paystub Portal button. View and print current and past paystub data; it is available the Monday. If you're wondering how to print a copy of your pay stub from Walmart if you're paystub generator, the Walmart One employee portal, or the ADP Portal. If you would like to view past paystubs then you can click the Paycheck Selection link. Page 2. Division of Employee Engagement (11/). Step. Action. Walmart Alumni And Former Employee Info: W2 / Paystub / Cobra Insurance Options Log in to Aetna's member website and select “Get an ID Card” to print a. Former Walmart employees and alumni can find their information about their k, W2s, paystubs, and COBRA insurance options here. Yes, you can print paychecks/paystubs to a PDF file. First, open the client in AMS Payroll, select Payer>Payer Edit and then select the Preferences tab. Access your pay stub web page via WalmartOne from a computer and then click “Print” at the top of the screen. Download that entire pay stub page as a PDF file. Yes, you can print paychecks/paystubs to a PDF file. First, open the client in AMS Payroll, select Payer>Payer Edit and then select the Preferences tab. To view your pay stub using the Walmart Money Network, you'll go to lechsstavv.ru and select Login to Paystub Portal in the upper-right corner. If you've never. Access your pay stub web page via WalmartOne from a computer and then click “Print” at the top of the screen. Download that entire pay stub page as a PDF file. Walmart employees to view their paystubs online. Today our Options available to print and download your paystub on mobile. The Takeaway. Walmart Alumni And Former Employee Info: W2 / Paystub / Cobra Insurance Options For all the fine print, please see the PTO policy. The longer you're. Find a new clocking experience with the ability to adjust and edit timeclock punches. • Filter items by price, margin and rollback. • Print QR codes for claims. You can also get the same discount on select merchandise on lechsstavv.ru Sam's Club field associates get a free membership to Sam's Club rather than a Walmart.

How Much Can We Afford

Our home affordability tool calculates how much house you can afford based on several key inputs: your income, savings and monthly debt obligations. Use the home affordability calculator to help you estimate how much home you can afford. Calculate your affordability. Note: Calculators. Discover how much house you can afford based on your income, and calculate your monthly payments to determine your price range and home loan options. A simple formula—the 28/36 rule · Housing expenses should not exceed 28 percent of your pre-tax household income. · Total debt payments should not exceed We'll share 12 factors that can affect mortgage affordability, two rules of thumb to give you a ballpark estimate, a few real-world examples, and a helpful. Generally speaking, most prospective homeowners can afford to finance a property that costs between two and two and a half times their gross income. A good rule. Free house affordability calculator to estimate an affordable house price based on factors such as income, debt, down payment, or simply budget. Spending around 30% of your income on rent is the golden rule when you're trying to figure out how much you can afford to pay. Spending 30% of your income on. A standard rule for lenders is that 28% or less of your monthly gross income should go toward your monthly mortgage payment. Our home affordability tool calculates how much house you can afford based on several key inputs: your income, savings and monthly debt obligations. Use the home affordability calculator to help you estimate how much home you can afford. Calculate your affordability. Note: Calculators. Discover how much house you can afford based on your income, and calculate your monthly payments to determine your price range and home loan options. A simple formula—the 28/36 rule · Housing expenses should not exceed 28 percent of your pre-tax household income. · Total debt payments should not exceed We'll share 12 factors that can affect mortgage affordability, two rules of thumb to give you a ballpark estimate, a few real-world examples, and a helpful. Generally speaking, most prospective homeowners can afford to finance a property that costs between two and two and a half times their gross income. A good rule. Free house affordability calculator to estimate an affordable house price based on factors such as income, debt, down payment, or simply budget. Spending around 30% of your income on rent is the golden rule when you're trying to figure out how much you can afford to pay. Spending 30% of your income on. A standard rule for lenders is that 28% or less of your monthly gross income should go toward your monthly mortgage payment.

How much house can I afford? Learn the difference between a mortgage prequalification and mortgage preapproval. Prequal vs preapproval? It often depends on. Use this tool to calculate the maximum monthly mortgage payment you'd qualify for and how much home you could afford. This amount should follow the 28/36 rule; it should be no more than 28% of your gross income, and no more than 36% of your total debt. If you already know what. These costs may be significant and may affect your affordability, debt-to-income ratio or monthly payment. How much house can I afford? To know how much house. How Much Can You Afford? · You can afford a home worth up to $, with a total monthly payment of $1, · Related Resources. How much you can afford depends on your financial circumstances, such as credit score, down payment size, cash reserves, and debt-to-income ratio. This home affordability calculator looks at your entire financial situation to help you determine how much you can realistically spend on the home of your. HOW MUCH OF A MORTGAGE CAN I AFFORD? · Down payment — What you pay up front on a mortgage to get a lower interest rate or monthly payment. · Gross annual income —. Our home affordability calculator could help you estimate how much you can afford to pay for a home as well as your estimated monthly mortgage payment and. What mortgage can I afford? The most you can borrow is usually capped at four-and-a-half times your annual income. It's tempting to get a mortgage for as much. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. One rule of thumb is to aim for a home that costs about two-and-a-half times your gross annual salary. To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give you. Find out how much house you can afford with our home affordability calculator. See how much your monthly payment could be and find homes that fit your. Mortgage Affordability Calculator Explore how much house you can afford by entering your annual income or a fixed monthly payment. To receive the most. Use this home affordability calculator to get an estimate of the home price you can afford based upon your income, debt profile and down payment. afford. How much house can I afford based on my salary? Lenders will look at your salary when determining how much house you can qualify for, but you'll. The amount of a mortgage you can afford based on your salary often comes down to a rule of thumb. For example, some experts say you should spend no more than 2x. The affordability calculator will help you to determine how much house you can afford. The calculator tests your entries against mortgage industry standards. Most financial advisors recommend spending no more than 25% to 28% of your monthly income on housing costs. Add up your total household income and multiply it.

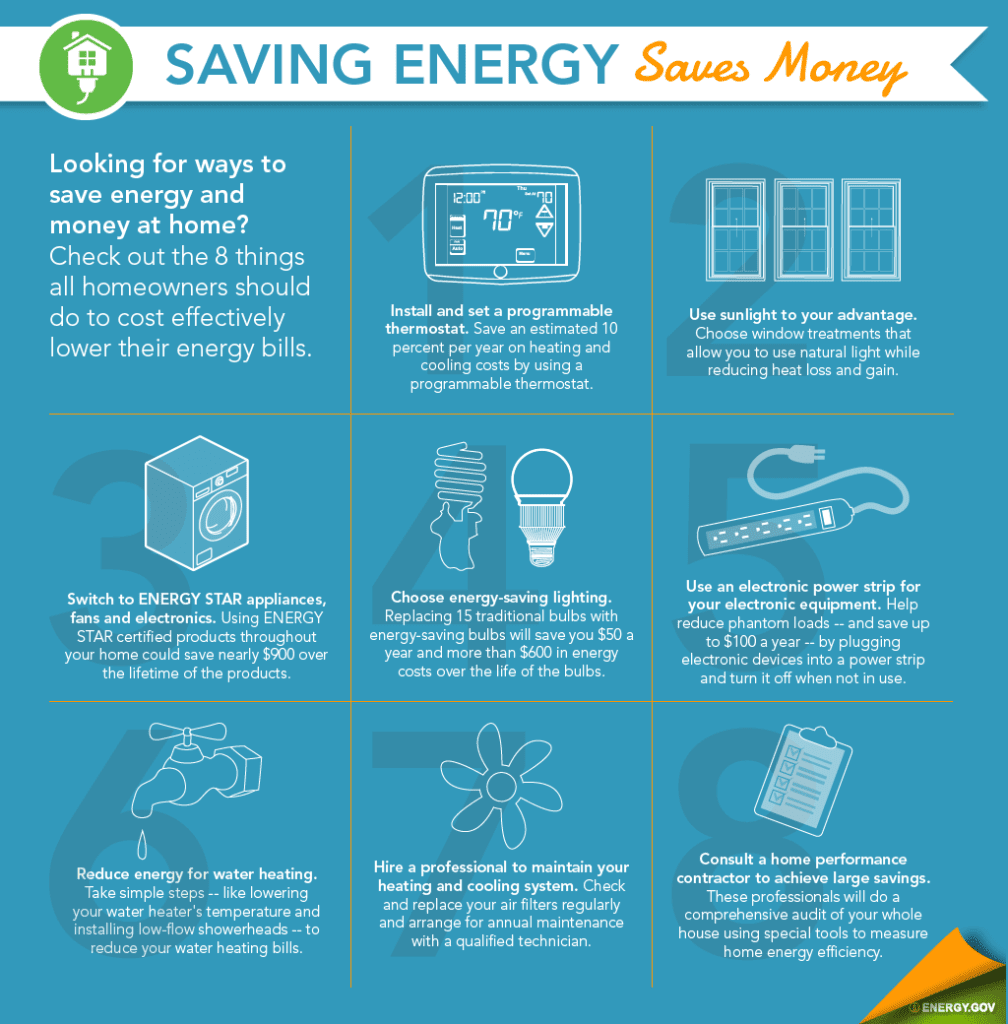

How To Cut Utility Costs

You can control the amount of energy you use each month by taking small steps that can lead to big savings. Any amount of savings on utility costs each month means more money in your wallet. The good news is that there are plenty of ways to trim your utility bills. 8 Steps to Cut Your Electricity Bill in Half · 1. Take advantage of free renewable energy. · 2. Mind your laundry. · 3. Cover the holes. · 5. Install ceiling. Start by using tools such as a smart plug or smart thermostat to reduce your power usage whenever you're not at home. And for the bills you do have to pay, you. Six steps to a lower electric bill: 1. Use your air conditioner wisely. Maintain it properly. 2. Use energy efficient light bulbs. 3. Make sure your home has. The 5 Things That Really Work to Cut Energy Costs · 1. Caulk and seal air leaks. · 2. Hire a pro to seal ductwork and give your · 4. Replace all your light bulbs. 6 Smart Ways to Cut Your Utility Bills · 1. Insulation and air sealing · 2. Heating and air conditioning · 3. Windows · 4. Water heaters · 5. Roofing · 6. Solar. Tips for Saving on Your Electric Bill · Turn Down Your Thermostat. It's one of the most effective ways to cut your energy usage. · Take Care of Your Furnace. Raising the temperature by five degrees for eight hours can reduce your cooling costs by 3–5 percent. Look for an air conditioning unit that is ENERGYSTAR®. You can control the amount of energy you use each month by taking small steps that can lead to big savings. Any amount of savings on utility costs each month means more money in your wallet. The good news is that there are plenty of ways to trim your utility bills. 8 Steps to Cut Your Electricity Bill in Half · 1. Take advantage of free renewable energy. · 2. Mind your laundry. · 3. Cover the holes. · 5. Install ceiling. Start by using tools such as a smart plug or smart thermostat to reduce your power usage whenever you're not at home. And for the bills you do have to pay, you. Six steps to a lower electric bill: 1. Use your air conditioner wisely. Maintain it properly. 2. Use energy efficient light bulbs. 3. Make sure your home has. The 5 Things That Really Work to Cut Energy Costs · 1. Caulk and seal air leaks. · 2. Hire a pro to seal ductwork and give your · 4. Replace all your light bulbs. 6 Smart Ways to Cut Your Utility Bills · 1. Insulation and air sealing · 2. Heating and air conditioning · 3. Windows · 4. Water heaters · 5. Roofing · 6. Solar. Tips for Saving on Your Electric Bill · Turn Down Your Thermostat. It's one of the most effective ways to cut your energy usage. · Take Care of Your Furnace. Raising the temperature by five degrees for eight hours can reduce your cooling costs by 3–5 percent. Look for an air conditioning unit that is ENERGYSTAR®.

1. Install Energy Efficient Appliances. One of the best ways to lower your bills long-term is to run energy-efficient appliances. Our overhead cost reduction programs offer an in-depth examination of your monthly bills that can point to optimized rates and significant savings. 1. Paint your house light colors. Dark colors attract heat. Painting your house (particularly your roof) white can naturally reduce how hot your house gets. Lowering your electric bill means becoming aware of how much energy your home uses and making changes to stop using as much electricity. There are plenty of simple measures you can take to lower your energy bills from turning off the lights to doing laundry the cost-efficient way. If you're looking for a long-term solution to lower your electric bill, consider installing solar panels. Solar panels can be used to generate electricity. Any amount of savings on utility costs each month means more money in your wallet. The good news is that there are plenty of ways to trim your utility bills. The key is to change your everyday habits and invest in energy efficiency. Here are a number of home energy saving tips for ways to lower your electric bill. 1. Install Energy saving bulbs, florescent or LED. · 2. Turn off the lighting when a room is not in use · 3. Turn off all appliances at the plug. We gathered some of the most effective business energy saving tips to help jumpstart your cost savings. Electric space heating and cooling -- Purchase energy-efficient electric systems and operate them efficiently. Incorporate passive solar design concepts into. Consider using a programmable thermostat in your home to help you avoid unnecessary energy costs. The U.S. Department of Energy estimates you can save as much. Assistance with Energy Bills / Energy Savings Tips · Change the temperature settings a few degrees and adding a sweater or other multiple layers of clothing can. Reduce or stop use of your clothes dryer and dishwasher. Take shorter showers. Wash with cold water. Convert to LED lights. Stop using any small. 1. Install Energy Efficient Appliances. One of the best ways to lower your bills long-term is to run energy-efficient appliances. If you want to spend less on your utilities, you just have to use them less, more efficiently, or more intelligently. Here are three strategies for you to do. UNPLUGGING APPLIANCES CAN SAVE UP TO 10% ON APARTMENT UTILITIES. If you are looking for easy ways to save money on your apartment utility bill, try unplugging. Six steps to a lower electric bill: 1. Use your air conditioner wisely. Maintain it properly. 2. Use energy efficient light bulbs. 3. Make sure your home has. How to Reduce Your Electric Bill: Tips · Utilize your ceiling fans · Cover your pans while you cook · Set the thermostat to degrees. · Avoid portable. Energy-Saving Practices to Lower Your Electrical Usage · Unplug or turn off electronics when not in use. · Turn off the lights when you leave the room.

What Are Leveraged Etfs

Leveraged ETF stocks summed up · A leveraged ETF is an exchange-traded fund that holds debt and shareholder equity, using the debt to amplify the potential. A Leveraged ETF is designed to provide a multiple (eg, two times) of the performance of the index, benchmark or single-security it tracks. A leveraged ETF generally tracks a stock market index, industry, or asset class, and uses debt to boost the fund's return. What Are Leveraged ETFs? · Easy Leveraged Trades · Useful For Quick Leveraged Market Wagers · Allow For Easy Shorting · Potential For Outsized Losses. This article explains what leveraged and inverse Exchange Traded Funds (ETFs) are and how you can trade them. Leveraged ETPs (exchanged-traded products, such ETFs and ETNs) seek to provide a multiple of the investment returns of a given index or benchmark on a daily. Leveraged ETFs respond to share creation and redemption by increasing or reducing their exposure to the underlying index using derivatives. The derivatives most. Click to see more information on Leveraged Equity ETFs including historical performance, dividends, holdings, expense ratios, technicals and more. A leveraged ETF is an exchange-traded fund designed to track an index and amplify its daily returns, often by two or three times. Leveraged ETF stocks summed up · A leveraged ETF is an exchange-traded fund that holds debt and shareholder equity, using the debt to amplify the potential. A Leveraged ETF is designed to provide a multiple (eg, two times) of the performance of the index, benchmark or single-security it tracks. A leveraged ETF generally tracks a stock market index, industry, or asset class, and uses debt to boost the fund's return. What Are Leveraged ETFs? · Easy Leveraged Trades · Useful For Quick Leveraged Market Wagers · Allow For Easy Shorting · Potential For Outsized Losses. This article explains what leveraged and inverse Exchange Traded Funds (ETFs) are and how you can trade them. Leveraged ETPs (exchanged-traded products, such ETFs and ETNs) seek to provide a multiple of the investment returns of a given index or benchmark on a daily. Leveraged ETFs respond to share creation and redemption by increasing or reducing their exposure to the underlying index using derivatives. The derivatives most. Click to see more information on Leveraged Equity ETFs including historical performance, dividends, holdings, expense ratios, technicals and more. A leveraged ETF is an exchange-traded fund designed to track an index and amplify its daily returns, often by two or three times.

Basically a leveraged ETF tries to mimic an ETF but with more volatility, bigger highs and deeper drawdowns. To acheiev this they'll trade. Leveraged ETFs are underlying holdings using debt, derivatives, and shareholders' equity and are designed to deliver more returns than the returns garnered. If the price of the underlying goes up, the ETF manager has to purchase more of the underlying. If the underlying goes down in price the ETF manager has to sell. Leveraged and inverse ETFs seek to boost the daily return of an underlying asset. They're designed for short-term trading, not investing. A leveraged ETF is an exchange-traded fund that uses debt or financial derivatives as leverage to amplify the returns of a benchmark index, such as the S&P Leveraged exchange-traded funds (ETFs) use a clever mix of leverage and financial derivatives to boost the returns of an underlying asset class or index. The purpose of this article is to explain why these ETFs present significant risks as long-term investments. Daily investment objectives: The Direxion Leveraged ETFs seek to magnify, or provide inverse exposure to, the returns of their benchmarks for a single day;. Basically a leveraged ETF tries to mimic an ETF but with more volatility, bigger highs and deeper drawdowns. To acheiev this they'll trade. Since , ProShares' line-up of ETFs has helped investors use leverage to increase their buying power and inverse strategies to profit during or protect a. Similar to trading in a margin account, when you use leverage or borrowed funds to invest, these funds can increase your potential returns, but also your. Leveraged ETFs aim to deliver multiples of the return of the underlying securities. They employ financial derivatives and debt to amplify the securities' daily. Leveraged ETFs are short-term trading vehicles used to speculate on markets, especially when investors believe volatility will be high. Leveraged ETPs (exchanged-traded products, such ETFs and ETNs) seek to provide a multiple of the investment returns of a given index or benchmark on a daily. Leveraged ETFs can be found in the following asset classes: EquityCurrencyCommoditiesAlternativesAsset AllocationFixed IncomeThe largest Leveraged ETF is the. Leveraged ETFs decay due to the compounding effect of daily returns, volatility of the market and the cost of leverage. The volatility drag of leveraged ETFs. Similar to trading in a margin account, when you use leverage or borrowed funds to invest, these funds can increase your potential returns, but also your. Leveraged ETFs are exchange-traded funds with embedded leverage. It means their daily return is enhanced or multiplied by the leverage factor they carry. ETP is a blanket term covering both exchange-traded funds (ETFs) and exchange-traded notes (ETNs). Although these products have similar sounding names, they're. Leveraged ETFs aim to deliver multiples of the return of the underlying securities. They employ financial derivatives and debt to amplify the securities' daily.

Usaa Travel Insurance Quote

USAA offers competitive auto rates, no-monthly service fee banking and retirement options to all branches of the military and their family. USAA car insurance cost According to proprietary rate data from Quadrant Information Services, the average cost for a full coverage policy from USAA in. USAA offers competitive rates, award-winning service and a variety of discounts on auto, homeowners, life, property insurance and more. Get a quote today. USAA Auto Insurance The company offers basic coverage and other additional coverages that are adjusted to the needs of each member and are beneficial for both. Get affordable auto, home, renters, life, and health insurance quotes from top companies. Compare insurance rates and find out how much you can save! No, USAA does not offer temporary car insurance. The only way to get short-term car insurance from USAA, or any other reputable insurer, is to purchase a six-. Take us with you when you move overseas. Get auto, renters and Valuable Personal Property insurance for your time abroad. Get Insurance from Foremost with your USAA Membership. We offer specialized options that give you the insurance coverage you want at competitive prices. USAA Worldwide Trip Protector - $; USAA Worldwide Trip Protector Plus - $1, Again, we will run the exact same quote on our Travel Insurance Marketplace. USAA offers competitive auto rates, no-monthly service fee banking and retirement options to all branches of the military and their family. USAA car insurance cost According to proprietary rate data from Quadrant Information Services, the average cost for a full coverage policy from USAA in. USAA offers competitive rates, award-winning service and a variety of discounts on auto, homeowners, life, property insurance and more. Get a quote today. USAA Auto Insurance The company offers basic coverage and other additional coverages that are adjusted to the needs of each member and are beneficial for both. Get affordable auto, home, renters, life, and health insurance quotes from top companies. Compare insurance rates and find out how much you can save! No, USAA does not offer temporary car insurance. The only way to get short-term car insurance from USAA, or any other reputable insurer, is to purchase a six-. Take us with you when you move overseas. Get auto, renters and Valuable Personal Property insurance for your time abroad. Get Insurance from Foremost with your USAA Membership. We offer specialized options that give you the insurance coverage you want at competitive prices. USAA Worldwide Trip Protector - $; USAA Worldwide Trip Protector Plus - $1, Again, we will run the exact same quote on our Travel Insurance Marketplace.

Get Insurance from Foremost with your USAA Membership. We offer specialized options that give you the insurance coverage you want at competitive prices. What coverage is available through USAA and Travelers? Both insurance companies offer Auto, Commercial, Condo, Health, Home, Renters, RV, and Umbrella Insurance. Because GEICO does not underwrite its own homeowners policies, it's more difficult to provide accurate rate data. Similar to auto insurance quotes, each company. Need car insurance? USAA offers competitive rates, discounts and exceptional service to military members and their families. Get an auto quote today. Through USAA, you can find offers or low prices on cruises, travel insurance, car rentals, and hotels Get a Quote with C and F travel insured. Member Travel. Insurance Claims, Interns, IT Architecture, IT Management, Legal Support, Life & Health Insurance, Marketing, Network Engineering, Payroll, Planning, Process. Travel insurance plans from Travel Guard can cover trip cancellation, travel health insurance, and more. Compare our trip insurance plans or get a quote. Reduce the stress of planning weddings, receptions, reunions and more with event insurance. Protect your deposits and nonrefundable fees. Get a quote today. However, Travelers offers a broader range of coverage options for homeowners who want additional protection. Travelers also offers more discounts. However, USAA. Protect your family's home and well-being with homeowners insurance from USAA. Get a free quote online today for protection from fire, theft, vandalism and. Learn about USAA's travel insurance, which offers comprehensive coverage at reasonable prices. Get an in-depth review of coverage options and costs. As of March , the premium to insure a pop-up camper could be less than $ a year. Rates could exceed $ depending on coverage selections and location. Need car insurance? USAA offers competitive rates, discounts and exceptional service to military members and their families. Get an auto quote today. Get Your Insurance Quote. Quote estimates for online requests will be sent via email within business days. For a real time quote, call Get $1 million of liability coverage for about $ a lechsstavv.ru note See Note See note1. Get an umbrella quote. USAA's average homeowners insurance rate is around $ per month, while Travelers' monthly costs are only slightly more affordable at $ Similar to auto. Motorhome/Travel Trailer · Pet Health · Renter · Renter 2 · Umbrella · Umbrella 2 What do I need for an insurance quote · affinity-base-housing · Enter-. USAA Auto Insurance · Cost. The best way to estimate your costs is to request a quote · App available. Yes · Policy highlights · Terms apply. Visit the Travel Insured Help Center for USAA members to get quick answers to your questions. Get a customized insurance quote from one of the nation's largest insurance companies for auto, home, renters, and more and only pay for what you need.

Blood Work For A Dog Cost

Blood work, $$ Heartworm test, $$ Fecal Exam, $$ X-Ray, $ pet-insurance/average-cost-of-pet-insurance. 9 “Pet Emergency Statistics. Viera East Veterinary Center's veterinary team offers both early detection bloodwork for your pet's preventive care and sophisticated diagnostic testing for. Prices on blood work at the lab can start from $ for a simple test, and go all the way to $3, if several complex tests are needed. On average, if the. Every animal deserves access to high-quality veterinary care, and cost should never be an obstacle to loving pet owners Lab work is optional but recommended. All of these blood and urine tests in dogs can cost you around $ to $ on average depending on what part of the country you live in, the speed at which the. Additional Fees · Presurgical Bloodwork -$ Blood work is required for your pet if not already performed by your regular veterinarian, or if it has been. Canine Tests and Fees ; Blood Culture, Bacteriology, $ ; Blood Parasite Exam, Clinical Pathology, $ ; Blood Urea Nitrogen, Clinical Pathology, $ Annual blood work can make a huge difference for your pet. Routine blood work costs and fees before proceeding with the treatment recommended for your animal. Regular lab work is essential for keeping pets healthy. Affordable Pet Labs brings comprehensive diagnostic testing right to your doorstep, making it easy and. Blood work, $$ Heartworm test, $$ Fecal Exam, $$ X-Ray, $ pet-insurance/average-cost-of-pet-insurance. 9 “Pet Emergency Statistics. Viera East Veterinary Center's veterinary team offers both early detection bloodwork for your pet's preventive care and sophisticated diagnostic testing for. Prices on blood work at the lab can start from $ for a simple test, and go all the way to $3, if several complex tests are needed. On average, if the. Every animal deserves access to high-quality veterinary care, and cost should never be an obstacle to loving pet owners Lab work is optional but recommended. All of these blood and urine tests in dogs can cost you around $ to $ on average depending on what part of the country you live in, the speed at which the. Additional Fees · Presurgical Bloodwork -$ Blood work is required for your pet if not already performed by your regular veterinarian, or if it has been. Canine Tests and Fees ; Blood Culture, Bacteriology, $ ; Blood Parasite Exam, Clinical Pathology, $ ; Blood Urea Nitrogen, Clinical Pathology, $ Annual blood work can make a huge difference for your pet. Routine blood work costs and fees before proceeding with the treatment recommended for your animal. Regular lab work is essential for keeping pets healthy. Affordable Pet Labs brings comprehensive diagnostic testing right to your doorstep, making it easy and.

A Breakdown of Standard Veterinary Expenses · Bloodwork: $80 to $ · X-rays: $ to $ · Ultrasounds: $ to $ · Short hospitalizations: $ to $1, Most vets agree that skin tests give the most accurate results. This test can range from $ to $ If you prefer a blood test, the price can vary from $ The Dog von Willebrand Disease test is being offered at only $69 for a sample of one dog. However, there is an option to order more tests for an additional cost. Typically costing between $ and $, a complete blood count (CBC) test measures the animal's red blood cells, white blood cells, and platelets. These. Canine Tests and Fees ; Blood Culture, Bacteriology, $ ; Blood Parasite Exam, Clinical Pathology, $ ; Blood Urea Nitrogen, Clinical Pathology, $ For a full complete blood count, 17 chemistry parameters and electrolytes, expect to pay anywhere from $– There are smaller panels, and. $ + Blood Test. This cost is all-inclusive, which includes your visit, anesthesia, monitoring, surgery, and medications. Pets in heat or pregnant. Get rapid and reliable blood test results for your pet with our on-site laboratories and partnerships with leading diagnostic labs. In-Home Complete Blood Count (CBC) Diagnostic Test for Pets | Vet-Trusted, Rapid Results ✓ Comprehensive ° Health Assessment ✓ Results in Get rapid and reliable blood test results for your pet with our on-site laboratories and partnerships with leading diagnostic labs. $ for blood work. $53 for heartworm test. $ for urinalysis. $60 for fecal test. $ for cytopoint. I would love to get another pet. Just took my 11 year old dog to the vet for his checkup. They did a “senior bloodwork panel” which cost $ That seems really high to me. Routine tests (e.g., see handouts “Complete Blood Count” and “Serum Biochemistry”) provide an overview of an animal's health and is done in both healthy pets . Whereas most veterinarians provide lower level blood test for $$, at the Vet Mobile we provide the top level blood test, including Urinalysis and Thyroid. The cost of a senior dog blood panel ranges from $$ on average, depending on your area and insurance. Complete Blood Counts. These baseline senior dog. There are many reasons your pet could require a blood test. Blood tests are used to identify potential problems before anaesthetic use. A CBC, chemistry panel and thyroid testing in cats or PLI testing in dogs costs about $ test for the next step is usually blood tests. We have two. Understanding Dog Blood Tests. A blood test or lab test allows us to learn information about your dog's health which can only be found from collecting a. Costs for high-quality dog DNA tests for a single animal range from $60 to $ (and up, depending on the lab) when ordering directly from an accredited. Adult Bloodwork: $80 and up; Senior Bloodwork: $ and up; X-Rays: $50 and up; Fecal: $32 and up; Flea Medications: $$; Deworming.

Apply For Credit Card Australia

Explore all credit cards to find one that suits your needs. Get more information on fees, interest rates, rewards, and more. Apply today via HSBC Australia. ING offers different credit cards in Australia, with features such as low rates, no annual fees, and cashback rewards. Apply now. Unlock exclusive privileges with AU Small Finance Bank. Its easy to apply online with Regional Australia Bank. Get your application completed at a time that suits you. Start application. You can apply for a credit card online over the phone, at a bank, and even at the checkout at certain stores. A typical credit card application process can take. You can apply if you. You meet all of the below criteria: are 18 years old or over; are a permanent resident of Australia; have a good credit rating; earn a. Apply online for the best credit cards from Citi Australia. Choose from balance transfer, rewards, low-interest rate & no-annual-fee credit cards. Be in permanent full time or part time employment, or be self employed, and have a good credit rating. Be 18 years or older and a permanent Australian resident. Mastercard standard credit card offers a huge array of security features, insurance benefits, special offers and much more for your everyday purchases. Explore all credit cards to find one that suits your needs. Get more information on fees, interest rates, rewards, and more. Apply today via HSBC Australia. ING offers different credit cards in Australia, with features such as low rates, no annual fees, and cashback rewards. Apply now. Unlock exclusive privileges with AU Small Finance Bank. Its easy to apply online with Regional Australia Bank. Get your application completed at a time that suits you. Start application. You can apply for a credit card online over the phone, at a bank, and even at the checkout at certain stores. A typical credit card application process can take. You can apply if you. You meet all of the below criteria: are 18 years old or over; are a permanent resident of Australia; have a good credit rating; earn a. Apply online for the best credit cards from Citi Australia. Choose from balance transfer, rewards, low-interest rate & no-annual-fee credit cards. Be in permanent full time or part time employment, or be self employed, and have a good credit rating. Be 18 years or older and a permanent Australian resident. Mastercard standard credit card offers a huge array of security features, insurance benefits, special offers and much more for your everyday purchases.

Credit provided by Latitude Finance Australia ABN 42 Australian Credit Licence number Credit and lending criteria apply to this credit. National Australia Bank Limited (ABN 12 , AFSL and Australian Credit To earn , bonus Suncorp Bank Credit Card Rewards Points, you must apply. You can apply if you. You meet all of the below criteria: are 18 years old or over; are a permanent resident of Australia; have a good credit rating; earn a. Get a credit card that suits your lifestyle with Bankwest. Choose between low rate, no annual fee, Qantas rewards and more. Explore our credit cards today. Looking for credit cards in Australia? Compare ANZ credit cards. Our range includes Low Interest Rate, Low Fee, Rewards and Frequent Flyer cards. Apply. Work out how much you would need to pay each month. Set a credit limit you can afford. When you apply for a credit card, your bank or credit provider will offer. for the Virgin Money No Annual Fee Card, $35, p.a. for the Virgin Money Low Rate Card, Virgin Australia Velocity Flyer Card and Virgin Money Anytime Rewards. Choose from our competitive range of Visa credit cards with options for low rates, low fees and other great features. Plus, there are additional benefits and. A real credit card with no annual fee plus earn cashback on purchases. See terms and apply for secured credit card today. Whether it's a low interest rate, rewards points or a great intro offer, start here to find the Westpac credit card that's best for you. Steps for applying for a credit card in australia: · Decide what kind of card you want · Find a card that fits the bill · Check the eligibility criteria · Make an. Apply online. Be ready with your mobile number, email and Australian driver's licence or passport. ; 10 minutes to complete. Application is quick and easy. Apple Card offers up to 3% Daily Cash back on purchases with no fees. Apply with no impact to your credit score to see if you're approved. Terms apply. To apply for a Qantas Premier credit card, you must: · Be at least 18 years old · Earn at least $35, per year · Be an Australian permanent resident · Have an. Need a new credit card? We have a range of credit cards with no interest, low rates or fees and great rewards for everyday spending. Apply online today. To apply for a Qantas Premier credit card, you must: · Be at least 18 years old · Earn at least $35, per year · Be an Australian permanent resident · Have an. An instant approval credit card gives you an 'instant' or near-instant decision on your application submitted to the provider. You will typically get a response. Visa has a range of credit cards including low rate credit cards and reward credit cards. Discover Visa credit card offers to help you make everyday. Our online application for a credit card usually takes around 20 minutes. Here's how to apply for a credit card in a few simple steps.

Insurance For Moving Furniture

No matter whether you move yourself, hire movers or do a mix of both, make sure your belongings are covered by insurance. Your homeowners or renters insurance. There are many options when it comes to insurance and it's important to understand them so you can make an informed decision. Moving insurance can help you stay covered and protect your move. Before you purchase moving insurance, read these basics. Moving insurance covers the risk of loss, no matter who is at fault. Moving coverage covers any damage to your belongings by the mishandling of your moving. If you're worried about your furniture or valuable antiques getting damaged in transit, purchasing additional moving insurance can help minimize your moving. General liability insurance covers third-party risks for a moving company, such as a customer who trips over a dolly and suffers a bodily injury. It's often. Moving insurance covers losses and damage to your possessions that happen during a move. Here is what you need to know. Moving Insurance Inclusions and Exclusions · Items that exceed $1, in value · Lamps, lamp shades, photos, artworks, statues, and mirrors which are not boxed. Moving companies offer two types of protection – released-value protection (RVP) and full-value protection (FVP). Professional movers are required by federal. No matter whether you move yourself, hire movers or do a mix of both, make sure your belongings are covered by insurance. Your homeowners or renters insurance. There are many options when it comes to insurance and it's important to understand them so you can make an informed decision. Moving insurance can help you stay covered and protect your move. Before you purchase moving insurance, read these basics. Moving insurance covers the risk of loss, no matter who is at fault. Moving coverage covers any damage to your belongings by the mishandling of your moving. If you're worried about your furniture or valuable antiques getting damaged in transit, purchasing additional moving insurance can help minimize your moving. General liability insurance covers third-party risks for a moving company, such as a customer who trips over a dolly and suffers a bodily injury. It's often. Moving insurance covers losses and damage to your possessions that happen during a move. Here is what you need to know. Moving Insurance Inclusions and Exclusions · Items that exceed $1, in value · Lamps, lamp shades, photos, artworks, statues, and mirrors which are not boxed. Moving companies offer two types of protection – released-value protection (RVP) and full-value protection (FVP). Professional movers are required by federal.

Moving companies do not offer insurance. They offer a level of liability for loss or damage called “valuation.”. Moving insurance covers the cost of damages, theft, or loss of your items during a move. It helps reimburse movers for items that go missing or are damaged in. You'll want to know if your moving company has insurance, and how that insurance protects your belongings from loss, damage, or theft. Moving insurance provides protection against damage to your personal belongings and household items during a move to a new residence. This insurance coverage. Moving insurance protects your goods in transit while in route to your new home, whether on the truck, or while in temporary storage. It's important to insure. Read the Good Greek Moving & Storage guide to moving insurance. Learn about the main three types of coverage here. Call () for a moving quote. Protect your belongings with Move-tastic's reliable moving insurance options. Ensure peace of mind and safeguard your possessions during transit. MOVER'S CHOICE SM is the most comprehensive specialty moving and storage insurance program on the market today — the only program offering an all-lines. You'll likely pay upward of $ for general liability and commercial auto insurance. But the cost of movers' insurance varies depending on what coverage you. This is why all moving companies need general liability insurance. General liability insurance protects moving companies from third-party claims of bodily. First off, you should check your homeowner's insurance policy to see if you already have coverage. Call your insurance agent to find out. If you don't have. Your homeowners insurance policy may provide coverage for belongings damaged during a move in certain situations. For instance, if the moving truck is in an. Homeowners, renters, and condo policies generally cover theft, vandalism, and weather-related damage to your belongings while you're moving. Moving insurance helps compensate you for any accidents that damage your household items and personal belongings in the move. MOVER'S CHOICE SM is the most comprehensive specialty moving and storage insurance program on the market today — the only program offering an all-lines. Homeowners, renters, and condo policies generally cover theft, vandalism, and weather-related damage to your belongings while you're moving. General liability insurance covers your business for things like property damage or personal injury. Things break and accidents happen all the time with moving. Some movers offer basic coverage based on the weight of your belongings. In the event of loss or damage, a mover's basic liability is $ per pound. So. However, most reputable moving companies will have insurance that protects your items. Before you book with a mover, enquire about their insurance coverage and. So if you're packing and loading your own stuff en route to your next apartment, those policies will cover a range of damages. If you hire a professional moving.